Settling the house quicker means making more money from the negative points (what is today's interest rate for mortgages). When a lending institution offers you unfavorable points they are betting you will not pay off your mortgage quickly. Rolling the cost savings from the negative points into paying on the loan's balance extends the amount of time in which the points are successful for the property buyer.

Eventually they will end up paying more interest than they otherwise would have. For individuals using unfavorable points the break even date is the quantity of time before the bank would get the better end of the deal if they were offering loan provider credits. Purchasers who pay off the loan prior to the break even date while employing unfavorable points will make cash on the points.

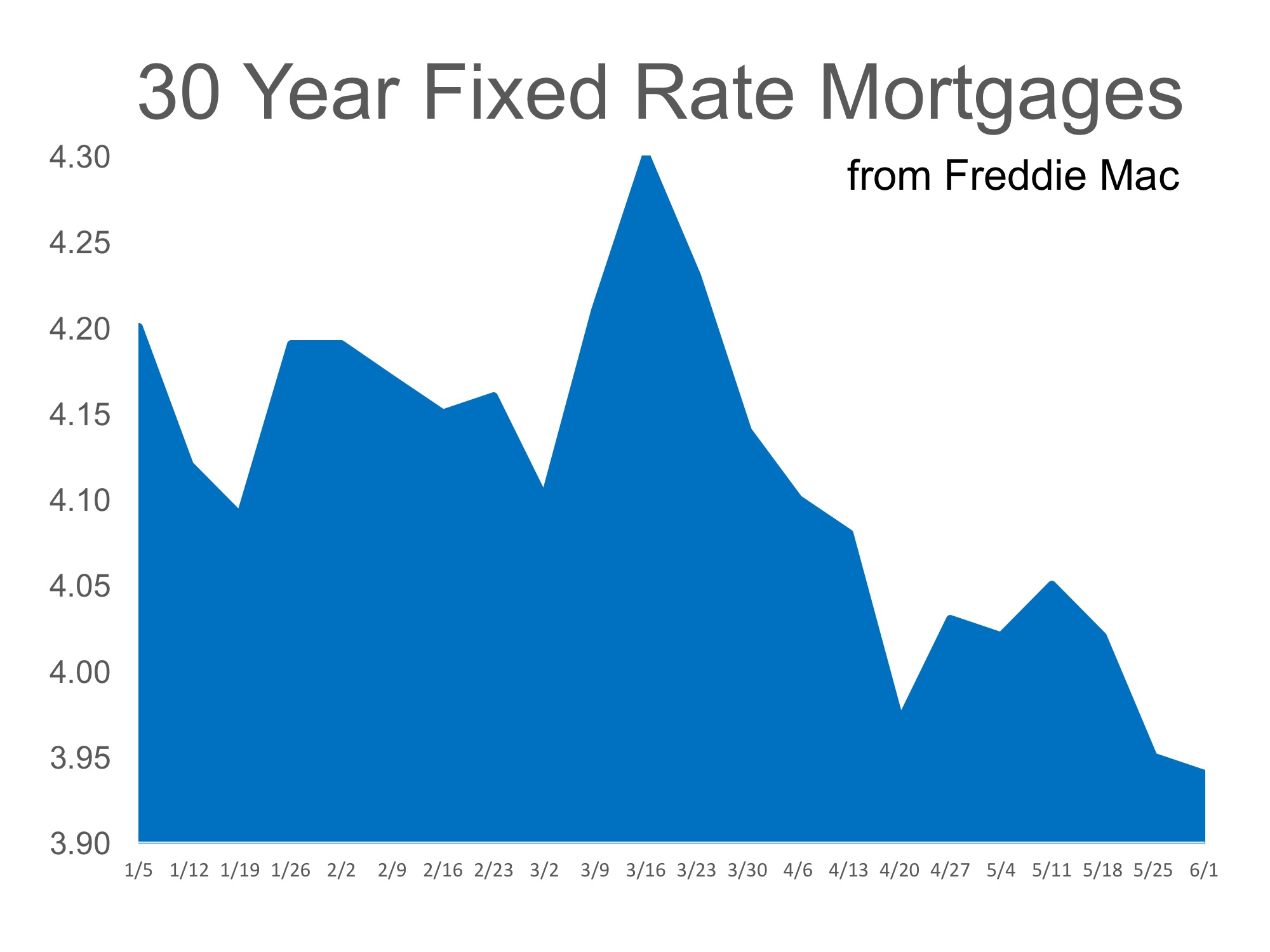

If you sell points you want to have the loan settled before you reach the http://zionoorw573.raidersfanteamshop.com/why-reverse-mortgages-are-a-bad-idea-for-dummies break even point so you are not paying the bank more interest than you would have if you selected not to purchase points. US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a threat off sentiment, with other financial rates falling in tandem. what are the best banks for mortgages.

Are you paying excessive for your home loan? Check your re-finance choices with a relied on Mountain View lending institution. Address a few concerns below and get in touch with a loan provider who can help myrtle beach timeshare rentals you refinance and save today!.

One hundredth of a percent per ten thousand signIn UnicodeU +2031 PER 10 THOUSAND INDICATION (HTML ‱ ‱ & pertenk;) RelatedSee alsoU +0025 % U +2030 PER MILLE INDICATION (per thousand) A basis point (typically abbreviated as bp, often pronounced as "bip" or "beep") is (a difference of) one hundredth of a percent or equivalently one percent of one percent or one ten thousandth.

Figures are commonly estimated in basis points in financing, especially in fixed earnings markets. Visualisation of 1%, 1, 1, 1 pcm and 1 ppm as fractions of the large block 1 basis point = (a difference of) 1 permyriad or one-hundredth of one percent. 1 bp = (a difference of) 1 or 0.

Not known Factual Statements About What Is The Current Apr For Mortgages

1 or 104 or 1/10,000 or 0. 0001. 10 bp = (a difference of) 0. 1% or 1 or 10. 100 bp = (a difference of) 1% or 10 or 100. Basis points are used as a practical unit of measurement in contexts where percentage differences of less than 1% are gone over.

For instance, a difference of 0. 10 percentage points is equivalent to a modification of 10 basis points (e. g., a 4. 67% rate increases by 10 basis indicate 4. 77%). Simply put, a boost of 100 basis points implies a rise by 1 percentage point. Like percentage points, basis points prevent the obscurity between relative and outright discussions about rates of interest by dealing only with the absolute modification in numerical value of a rate.

1% (relative, 1% of 10%), or from 10% to 11% (absolute, 1% plus 10%). Nevertheless, if the report says there has actually been a "100 basis point boost" from a 10% interest rate, then the rates of interest of 10% has increased by 1. 00% (the outright change) to an 11% rate.

Given that certain loans and bonds might frequently be quoted in relation to some index or underlying security, they will typically be priced estimate as a spread over (or under) the index. For instance, a loan that bears interest of 0. 50% per annum above the London Interbank Offered Rate (LIBOR) is said to be 50 basis points over LIBOR, which is frequently expressed as "L +50 bps" or just "L +50".

Considering that the basis is normally little, these are priced estimate increased up by 10,000, and thus a "complete point" motion in the "basis" is a basis point. Contrast with pips in FX forward markets. En lieu of referencing specific basis points for bigger percentages, the below terms have actually been getting traction and use in the monetary industry.

1%) 1 "UltraBip" = 100 bps = 1% 1 "GigaBip" = 1000 bps = 10% Cost ratios of investment funds are often priced quote in basis points. A related principle is one part per 10 thousand, 1/10,000. The same unit is also (hardly ever) called a permyriad, literally implying "for (every) myriad (10 thousand)".

What You Need To Know About Mortgages Fundamentals Explained

001 basis points. This is similar to the distinction between percentage and percentage point. A permyriad is written with U +2031 PER 10 THOUSAND SIGN (HTML ‱ ‱ & pertenk;-RRB- which looks like a percent sign % with 3 absolutely nos to the right of the slash. (It can be considered as an elegant type of the four absolutely nos in the denominator of "1/10,000", although it comes from as a natural extension of the percent % and permille indications.) " Beep".

" What is a basis point (BPS)?". Recovered 21 May 2010. " Basis point". Referral. com. Recovered 4 Jul 2010. Constable, Simon (September 4, 2013). " What Is a Basis Point and Why Is It So Essential?". Wall Street Journal. Dow Jones. Archived from the initial on 2016-10-09. Retrieved 2017-04-22. Financiers also refer to basis points when discussing the cost of shared funds and exchange-traded funds.

For example, the "Investor" share class of Vanguard Overall Stock Market Index, the largest stock mutual fund, has costs of 0. 17%, or 17 basis points. When individuals compare fund expenses, they determine the difference in basis points. A fund with expenses of 0. 45% is said to be 5 basis points more pricey than one with a 0.

" myriad". www. merriam-webster. com. Obtained 9 April 2018. " myriad". Dictionary. com. Retrieved 9 April 2018. (PDF). The Unicode Consortium. Obtained 17 Sep 2011.

For the 2nd week in a row, mortgage applications failed somewhat, falling 0. 6% from the week prior, according to a report from the Purchase applications took a struck recently, falling 2% from the week prior. However, they stayed 26% greater than this very same time last year. Refinances remained relatively steady over the previous week, however are 74% greater than the exact same week a year earlier.

The 30-year fixed rate climbed two basis points to 3. 02, the greatest considering that late September. "In spite of the uptick in rates, refinance activity held stable, with re-finance applications publishing a 17. 6 percent increase, assisting to offset decreases in the other loan types," stated Kan. Given the ongoing real estate market healing, Kan estimates property buyer demand will stay strong through the Fall.

A Biased View of Which Bank Is The Best For Mortgages

Here is a more detailed breakdown of this week's mortgage application information: The FHA's share of mortgage apps increased to 11. 8% from 10. 7%. The share of applications fell to 12. 6% from 13. 4%. The share of overall applications fell to 0. 5% from 0. 6%. The typical contract rate of interest for 30-year fixed-rate mortgages with adhering loan balances ($ 510,400 or less) increased to 3.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than Continue reading $510,400) increased to 3. 33% from 3. 3%. The average agreement rates of interest for 30-year fixed-rate home mortgages backed by the FHA stayed the same at 3. 12% from the week prior. The typical contract rates of interest for 15-year fixed-rate home mortgages increased to 2.